Do companies follow the same procure-to-pay procurement steps used in direct spending when making in-house related purchases?

The answer is yes.

They follow similar procure-to-pay procurement life cycle steps as when buying raw materials for fabrication of goods for sale.

But what exactly does procure-to-pay mean and indirect spend as well?

Let’s find out.

What is Procure-to-Pay?

Procure-to-Pay, sometimes also called Purchase-to-Pay (P2P), is a core part of an enterprise’s procurement process.

It is made up primarily of three main steps of the procurement lifecycle, namely requisitioning, purchasing, and payment.

What is Indirect Spend?

What is indirect spend and how does it differ from direct spending? This is a question posed by many.

Explained simply, indirect spend refers to all the service and maintenance fees and costs for materials consumed/used by employees on a day-to-day basis within the business.

Put another way, indirect spending is the money needed to run the business and keep it functioning at optimum.

It is distinct from direct spending in that the products or services are intended for internal use.

Where direct spending is concerned, purchasing decisions are being made to buy raw materials and or services to manufacture products that will be sold to consumers. In other words, direct spending is outward-focused.

Now that we know the meaning of procure-to-pay and indirect spend, let’s take a look at how companies make use of P2P for in-house procurement needs.

The P2P Process for Indirect Spend

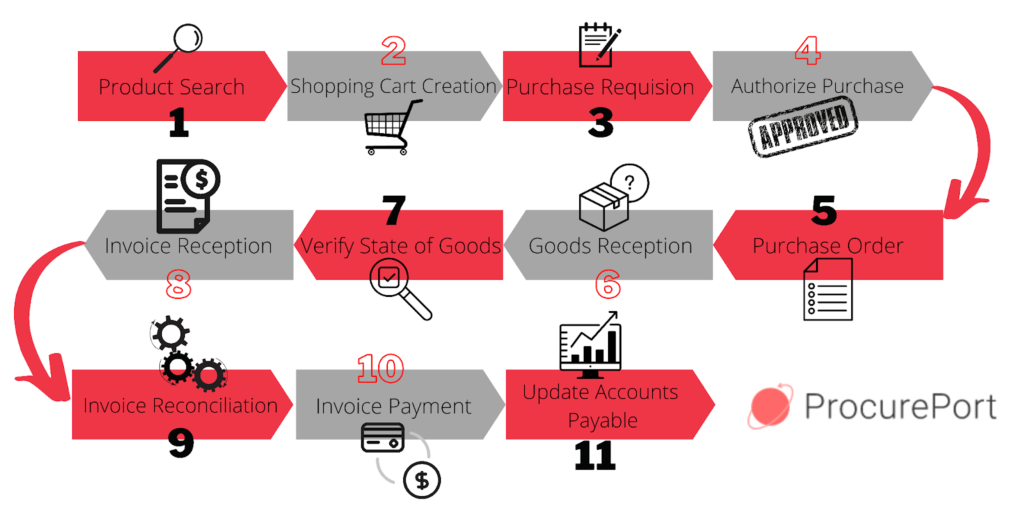

The procure-to-pay process for indirect spend has 3 main steps as we saw above (namely requisitioning, purchasing, and payment) but these can be further broken down to 11 stages as presented in the figure below:

Step 1: Product Search

The first step in the P2P process for indirect spending involves a search for the products that are required by the requisitioning employee.

Step 2: Shopping Cart Creation

Next, this is followed up by the creation of a shopping cart. Supplier or vendor catalogs are used to create the list of products to be filled onto the purchase requisition form.

Step 3: Create Purchase Requisition

Once the products, their specifications, and prices have been noted, a purchase requisition form is created by the requisitioning employee. This purchase requisition is an internal document sent for approval to the head of the department.

Step 4: Authorize Purchase

The purchase requisition must first be authorized before it can be processed into a purchase order. Authorization can be done by the accounts department, but for indirect spending above a set dollar amount, the company VP may need to sign off and approve the purchase requisition.

Step 5: Create Purchase Order

Once the approval has been granted for the indirect spend purchase requisition, a purchase order is created using the PR as a template. The purchase order is then sent to the chosen vendor, who processes it. After agreeing to fulfill the PO, the purchase order becomes a legally binding contract.

Step 6: Goods Reception

The supplier will ship products to the address on the purchase order or according to instructions listed in the PO. Goods are also to be delivered within the timeframe stated on the PO.

Step 7: Verify State of Goods

When the goods arrive at the buyer, the buyer inspects them to ensure they are neither damaged nor in a state that voids them. If the goods are accepted the buyer will ask the vendor to issue an invoice.

Step 8: Invoice Reception

The invoice is received by the accounts payable department who then move on to the next step which is invoice reconciliation and processing.

Step 9: Invoice Processing and Reconciliation

Invoice reconciliation invoices three-way matching of the initial purchase requisition, the purchase order, and the received invoice. This is done so that the supplier is paid exactly what was requested and delivered.

Step 10: Invoice Payment

Payment will be released according to the terms and conditions listed on the purchase order.

Step 11: Update Accounts Payable

Once the supplier has been paid, the accounts payable department will archive the invoice and update their spreadsheets.

The Need for Digital P2P Solutions for Indirect Spend

We all know how exhausting the purchase requisition and purchase order process can be when manually creating both a PR and PO using an Excel spreadsheet. Fortunately, this is now a thing of the past.

With digital procure-to-pay solutions, you can now streamline this part of the procurement process. That’s not all, however, but P2P systems also help in the following manner:

Improve Overall Procure-to-Pay Process Efficiency

Automation means you cut back on hours employees spend on repetitive tasks. Approval times are also significantly reduced. All of these benefits help to lower human resource costs.

Improves Procure-to-Pay Process Visibility

It’s very easy for indirect spending to get out of hand if there are no accountability systems in place. Digital P2P solutions provide the visibility and control accounts payable departments need to keep spending in check.

Eliminates Bottlenecks in the System

Do you know where your employees are wasting the most time during the P2P process? Do you know why things always seem to delay?

Well, when all your team members are working on a centralized platform, it’s easy to follow up and see where the hang-ups and bottlenecks are so you can remove them and improve your team’s effectiveness.

Learn more: Procurement Software Implementation in 3 Easy Steps

The Bottom Line

Procurement teams do not need to alter the procure-to-pay steps they follow during direct spending when they are purchasing goods for internal use.

Whether direct or indirect spend, make sure you’re working with reliable, robust, and innovative procurement process solutions such as those provided by ProcurePort.

Our software is the go-to for enterprises and organizations such as UNOPS, HUD.GOV, and conEdison.

To discuss procurement software with a consultant or to schedule a demo of our solutions, contact us today.