Expense management is a key concern in business because unmonitored spending can easily hurt an otherwise profitable enterprise. The management process involves tracking how employees are using their spending leeway and reimbursing such expenses. Expense management methods have evolved to include sophisticated software solutions that allow the collection of data for analytics processes.

The first and most unreliable way is paper tracking, where employees take physical receipts to the accounting department for approval and subsequent reimbursement. The manual verification process takes time, and reimbursements are likely to be paid only at the end of a month or a quarter. The next method, which is still common, is through spreadsheets. This allows for month-to-month comparisons as well as highlighting instances where expenditure goes beyond the budgeted amount.

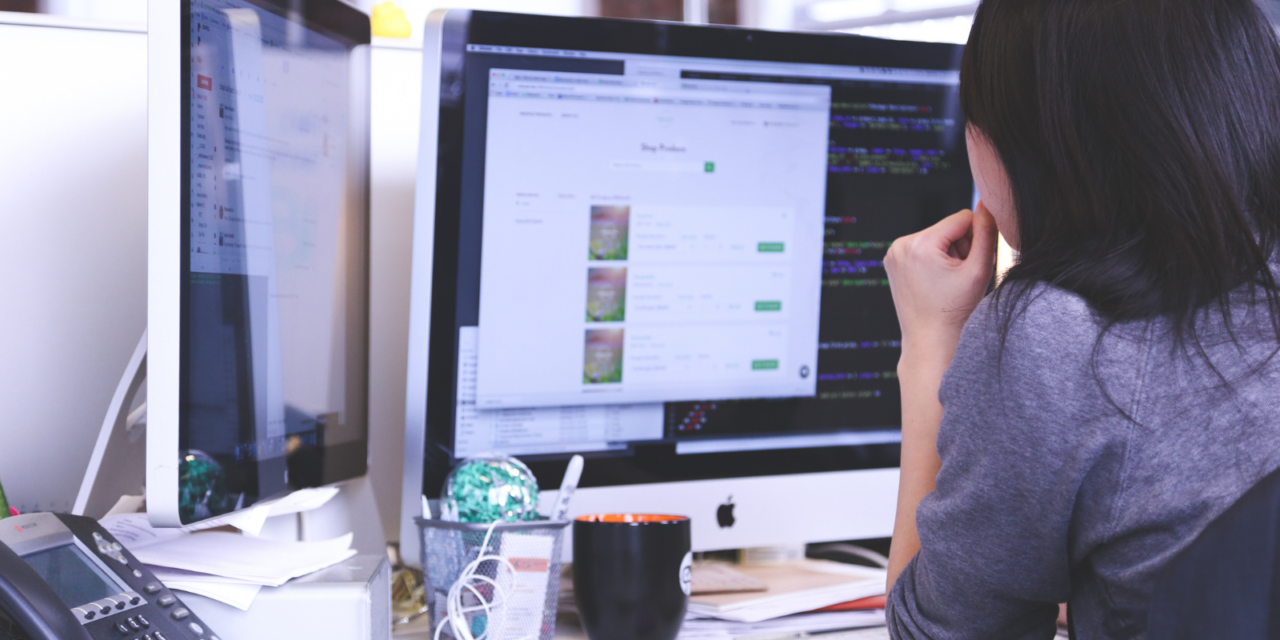

The next and best method is through expense management software. This is an application that enables a business to track different categories of expenses, approve expenditures, approve travel and expense management, and fast-track the reimbursement process.

How Expense Management Works with a Software

When working with software, the core process remains the same. However, the manual submission of documents for verification is eliminated. The expenses are logged into the software and employees can attach receipt copies (expense submission), which then go through the approval process. The software helps with checking whether any policies have been broken before the expense is approved or rejected. Approved payments are scheduled for payment and a report is generated. Rejected expenses are then investigated and an audit trail established.

Here are a few more specific things the software helps execute better.

1. Expense Tracking

A major problem in manual expense tracking is keeping track of the physical, paper receipts. If an employee loses a receipt, they are unlikely to get reimbursed for the expense unless they can provide alternative proof. However, expense management software allows several ways to submit receipts. They can accept images of the receipts or e-receipt copies.

Expense management software also eases the process of internal and external auditing. It’s easy to find supporting documents for every expense the business pays for. The auditors can easily monitor how a particular employee’s expenses have changed from one period to the next.

2. Policy Enforcement

It’s important for businesses to have a clear expense management policy. This should include a comprehensive list of those expense categories the business allows. The language used must be clear to avoid grey areas. The policy will inform the parameters that will be fed into the expense management software for automated enforcement. Whenever a breach occurs, the concerned authority gets notified immediately. In addition, the management can easily make amendments to the policies in line with budgetary allocations and strategic spend plans.

3. Quicker Approvals

Whenever a violation occurs, a report is sent to the relevant authorities with a reason for flagging together with the policy in question. This means that the investigating authority does not have to dig into policy documents or try finding the physical expense receipts. This quickens the process. In addition, sending a report to the correct person minimizes the disruption of workflow, which would otherwise occur when files are physically moved from one office to the next.

3. The Cost Savings of Expense Management Software

One of the major expense categories businesses must track is and reimburse employees for is travel. According to the Global Business Travel Association, manual processing of travel expense reports can be quite time-consuming. It takes on average 20 minutes to fill out an expense report and costs about $58. A further 18 minutes and $52 goes into correcting one of these reports. Software to streamline the process can slash these numbers significantly.

4. Compliance Enhancement

The different expense categories employees incur while on duty are treated differently by local, state, and federal tax authorities. Mileage allowances, flight tickets, and accommodation are deductible. However, some entertainment spending may not be deductible. The software enables the business to categorize and tag expenses correctly to avoid issues during tax audits. The business is also able to keep proper records for a long time should anything from the past be called into question.

5. Custom Reports

Managers have the added advantage of generating custom reports by querying the data collected by the software. For instance, it’s possible to see the average spending on hotel accommodation or flights. They can see the organizational total, the average, and the average for a specific employee. They can also track monthly reports to establish a trend. If the software has an analytics dashboard, reports can be visualized in charts. Querying custom reports helps in decision-making when attempting to control expenses and track procurement savings.

Choosing an Expense Management Software

When picking an expense management software, a business must be careful to go for one that complements its workflow without too much tweaking. Most off-the-shelf expense management software is built to fit a lot of businesses. It might be easier to adjust your workflow slightly to match the software you pick. The system should also be easy for your staff to work with. The user interface should be intuitive enough to suit both the young and older staff. As a manager, you must have the foresight to allocate resources for training the staff to use the software.

If your company needs software to ease expense management, get in touch with ProcurePort. We will recommend the right off-the-shelf or custom solution to suit your workflow. We have over 20 years of experience in providing e-procurement solutions and services that help drive down the cost of doing business. Get in touch with us today.